Understanding New Zealand Property Titles

The New Zealand property market is brimming with opportunities, but its complex landscape of titles can be a maze for many. Not all properties were created equal and whether you’re an aspiring homeowner or an investor, having a firm understanding of the different types of titles and their implications is crucial.

Before we get started though, it is important to note that in New Zealand we do not hold physical paper titles like many other countries around the world. Ownership of property is conveyed through lawyers and registered with Land Information New Zealand. This is a very secure system which means if your paper title is lost or stolen, you do not lose ownership of the property itself.

We should also note that New Zealand also has a complex ownership system when it comes to Maori land. Due to the complexities with these titles and the unlikelihood that it will affect everyday property investors we have not gone into any detail on these titles in this article. However if you do have a claim to papakainga land, we recommend you explore your options through more experienced professionals who specialise in this area.

Let’s take a dive deep into the multifaceted world of New Zealand property titles.

- Freehold Title (Fee Simple)

Freehold title, or fee simple, is the most common kind of property ownership in New Zealand and it is also the simplest. This title bestows full rights over the land and any structures present.

Details:

- Absolute Ownership: With no time constraints, Freehold title grants utmost ownership rights.

- Unparalleled Flexibility: Owners can modify, rent out, or sell their property, constrained only by relevant laws and regulations.

- Preferred Title: Given its unequivocal rights, Freehold titles are a favourite among developers and investors.

- Leasehold Title

Under a Leasehold title, you’d own the property or structure, but not the land—it’s leased from a Freehold owner.

Details:

- Time-Sensitive Ownership: These titles are time-bound, ranging from short terms to centuries-long leases.

- Ground Rent: Owners typically owe periodic ground rent to the land’s Freehold owner, which is susceptible to changes. There are also periodic rent reviews often based on the value of the land, therefore land value increases can result in lease increases.

- For the Seasoned Investor: Due to potential complexities, Wealth Mentor suggests novices avoid Leasehold titles. They’re better suited for those seasoned in property investment nuances.

- Cross Lease Title

Cross Lease titles materialise when multiple parties co-own a land parcel, but lease parts of it to each other. They were popular in the 70’s and 80’s as a cheap form of subdivision and before unit titles came in.

Details:

- Shared Land Ownership: This can either be on a Freehold or Leasehold basis, with the title encompassing both the lease document and flats plan.

- Detailed Lease Document: This document and accompanying flats plan delineate specific permissions and restrictions about property modifications and exclusive rights to certain areas of the land.

- Collaborative Decisions: Significant property changes usually necessitate consensus from all title holders and an update to all flats plans.

Operational Insights

- Tenancy Length and Occupancy: Inquire about the average tenancy duration and the typical occupancy level across a year. Understanding potential vacancy periods is vital for budgeting.

- Running Costs: Request a yearly estimate for property maintenance, providing foresight into expected expenses.

- Tenancy Processes: Gain clarity on tenant selection and termination procedures, ensuring alignment with your expectations.

- Legal Battles: Understand how often the manager personally has to pursue court cases against problematic tenants, indicating potential hassle and expense frequency.

- Unit Title (Stratum Estate)

Prominent in apartments and gated communities, Unit Titles split a property into private ‘units’ and communal ‘common areas’.

Details:

- Community Governance: A body corporate, constituted of all owners, governs shared spaces, assuring collective responsibility and decision-making.

- Guided by Law: The Unit Titles Act 2010 sets the framework for these titles, delineating rights and responsibilities.

- Maintenance Levies: Owners contribute financially towards the upkeep of communal spaces.

When purchasing a unit title property the seller must provide the following information about the unit and the body corporate:

- A pre-contract disclosure statement must be provided prior to entering into a sale and purchase agreement

- A pre-settlement disclosure statement must be provided after entering into the agreement to purchase but prior to the property settling.

The Lawyer’s Role & Legal Instruments on Property Titles

Engaging a seasoned lawyer is indispensable for understanding intricate details recorded on titles. Several legal instruments, including easements, mortgages, covenants, caveats, and more, might be listed on a title.

- Easements: An easement grants specific rights over a land parcel to someone, possibly affecting its usage. Common easements include rights of way or drainage easements.

- Mortgages: Representing a lender’s claim on a property, a mortgage is usually settled first if a property gets sold.

- Covenants: These contractual obligations may govern land use, such as building restrictions or land maintenance duties.

- Caveats: A caveat serves as a warning or notice to anyone wanting to deal with the property. It protects a person’s rights to the land, ensuring no dealings occur without their knowledge.

- Other Legal Instruments: From liens, which safeguard creditor’s interests, to rights of way permitting passage over land, these instruments can significantly influence an owner’s rights and a property’s valuation.

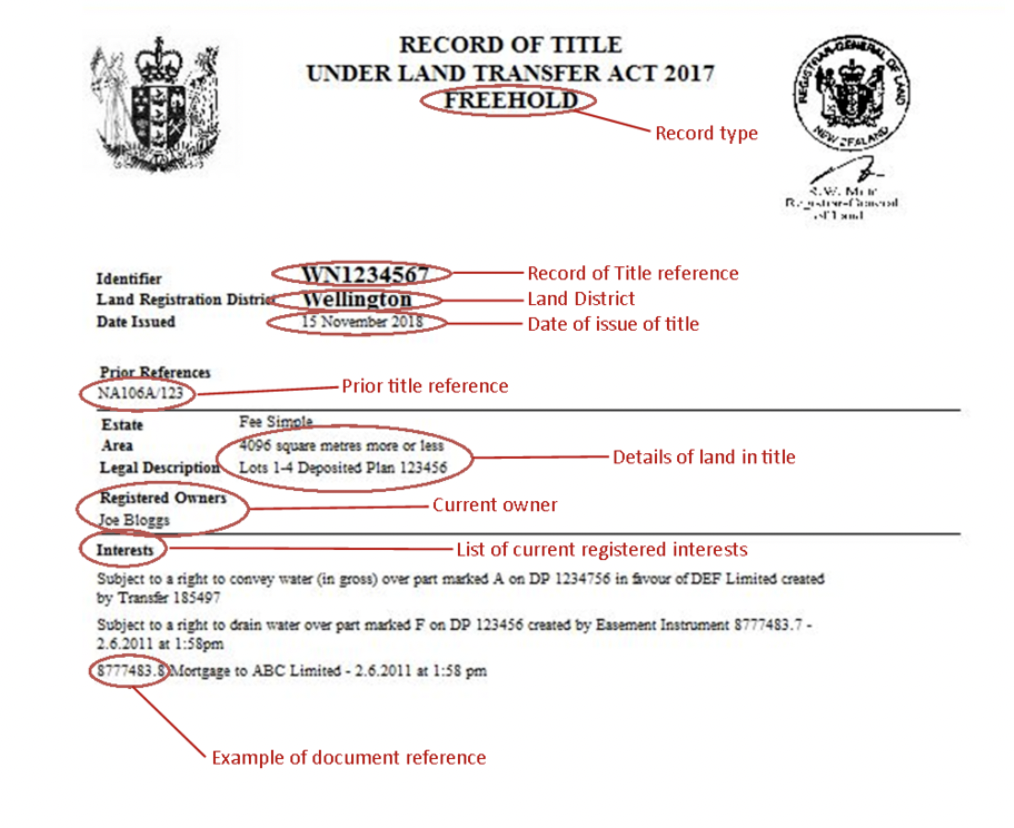

Understanding what is on the properties title is a key part of your Due Diligence. You can obtain a copy of the property title through the Real Estate Agent or your lawyer. Or you can even purchase a copy of the title directly through Land Information New Zealand yourself, including being able to search any instrument recorded on the title.

Below is an example image of a certificate of title provided by Land Information New Zealand. On it they highlight the key information you can expect to see on a title and a number of example legal instruments that you would typically find on a title.

Knowledge, when paired with expert counsel, can transform challenges into opportunities. By comprehending the nuances of New Zealand property titles and the myriad legal instruments they may encompass, you’re well-placed for confident, informed decisions. When considering any property venture, always consult legal professionals.

Keen on navigating New Zealand’s property sector? Wealth Mentor is here to guide you, illuminating the path to successful property investments.

See our events page for our next webinar or masterclass.